Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ | | | Preliminary Proxy Statement | Filed by the Registrant x ☐

| | | | Filed by a Party other than the Registrant o

| Check the appropriate box: | o | | Preliminary Proxy Statement | o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ý☒ | | | Definitive Proxy Statement | o ☐ | | | Definitive Additional Materials | o ☐ | | | Soliciting Material Pursuant to §240.14a-12 |

Simpson Manufacturing Co., Inc. | (Name of Registrant as Specified In Its Charter) | (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | ý☒ | | | No fee required. | o ☐ | | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | | (1 | )(1) | | | Title of each class of securities to which transaction applies: | | | (2 | ) | | | | | | | (2) | | | Aggregate number of securities to which transaction applies: | | | (3 | ) | | | | | | | (3) | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | | | (4 | ) | | | | | | | (4) | | | Proposed maximum aggregate value of transaction: | | | (5 | ) | | | | | | | (5) | | | Total fee paid: | o | | | | | | | ☐ | ��� | | Fee paid previously with preliminary materials. | o ☐ | | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | | (1 | )(1) | | | Amount Previously Paid: | | | (2 | ) | | | | | | | (2) | | | Form, Schedule or Registration Statement No.: | | | (3 | ) | | Filing Party: | | | | (4 | )(3) | | Date Filed: | Filing Party: | | | | | | | | | | | (4) | | | Date Filed: | | | | | | | | | | | | | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

SIMPSON MANUFACTURING CO., INC.

5956 W. Las Positas Blvd.

Pleasanton, California 94588

Voting Roadmap

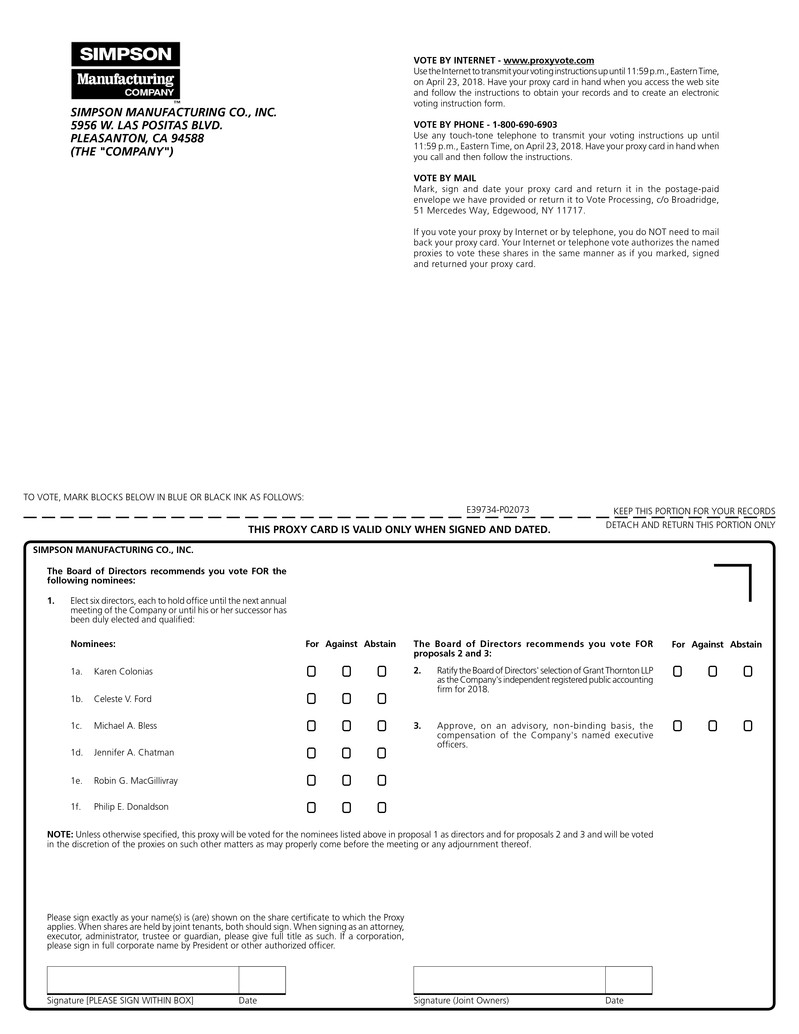

At the 2018 Annual Meeting, the Company’s board of directors (the “Board”) is recommending six highly qualified and experienced nominees for election to the Board at the 2018 Annual Meeting: Karen Colonias, our CEO, Celeste Volz Ford, the CEO of Stellar Solutions, Inc., an established aerospace company, Michael A. Bless, the CEO of Century Aluminum Company, a global producer of primary aluminum, Jennifer A. Chatman, the Paul J. Cortese Distinguished Professor of Management Haas School of Business, at the University of California, Berkeley, a top business school, Robin G. MacGillivray, a former executive at AT&T Inc., a leading telecommunications company, and Philip E. Donaldson, Executive Vice President and Chief Financial Officer of Andersen Corporation, a leading international window and door manufacturing company. The Board is soliciting you to take the following actions and vote your shares of our common stock on the following proposals submitted for the 2018 Annual Meeting in the manner as recommended below:

| | | | | | Proposal | | Solicited Actions | | | 1 | | Elect six directors, each to hold office until the next annual meeting or until his or her successor has been duly elected and qualified. | | For the Board’s six nominees | 2 | | Ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for 2018. | | For | 3 | | Approve, on an advisory basis, the compensation of our named executive officers (“NEOs”). | | For |

THE BOARD UNANIMOUSLY RECOMMENDS A VOTEFORTHE ELECTIONTABLE OF EACHCONTENTS TABLE OF THE BOARD’S NOMINEES ON PROPOSAL 1 USING THE ENCLOSED PROXY CARD.CONTENTS THE BOARD UNANIMOUSLY RECOMMENDS VOTINGFORPROPOSALS 2 AND 3.LETTER TO STOCKHOLDERSDear Shareholders:To Our Fellow Stockholders:

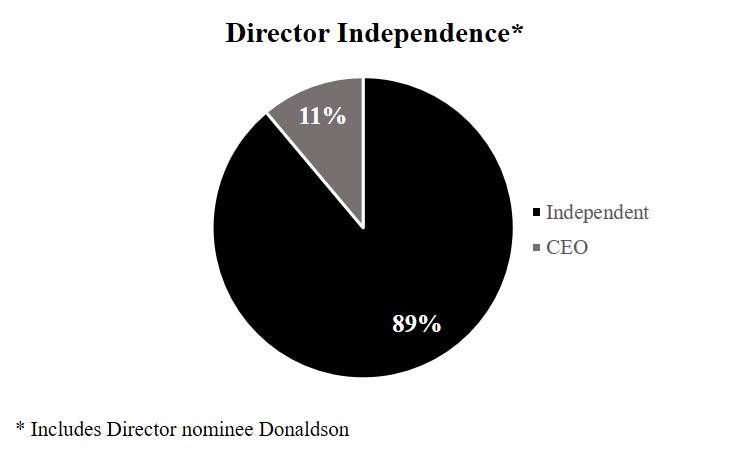

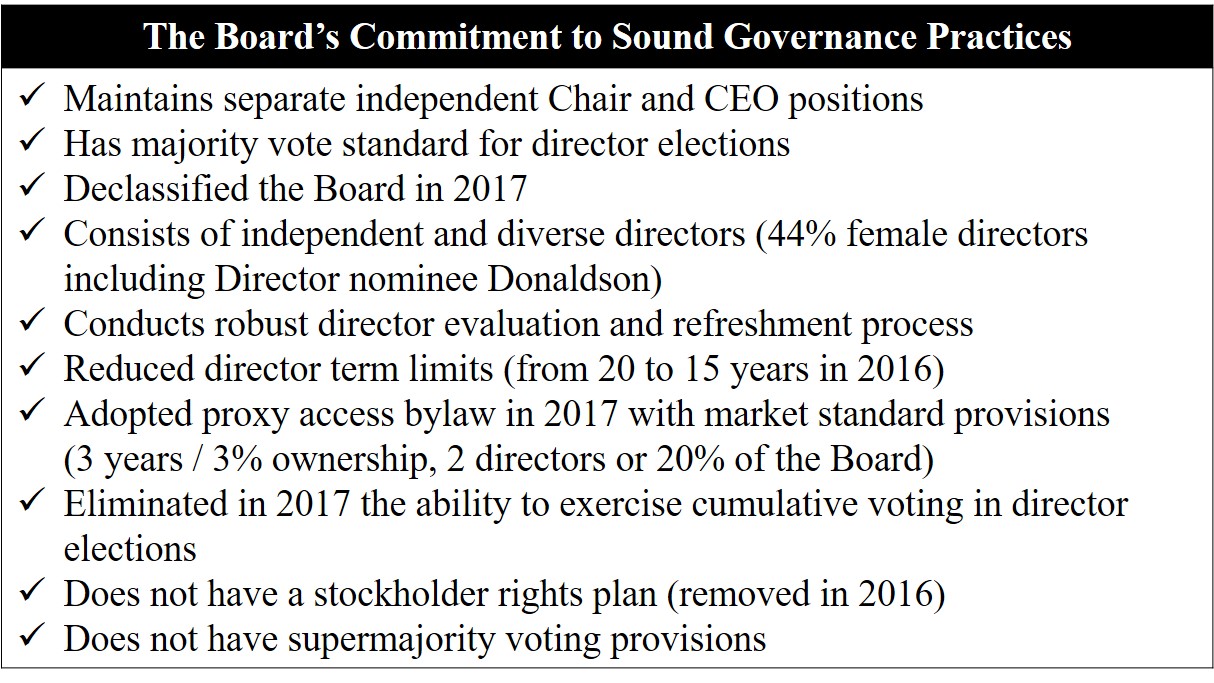

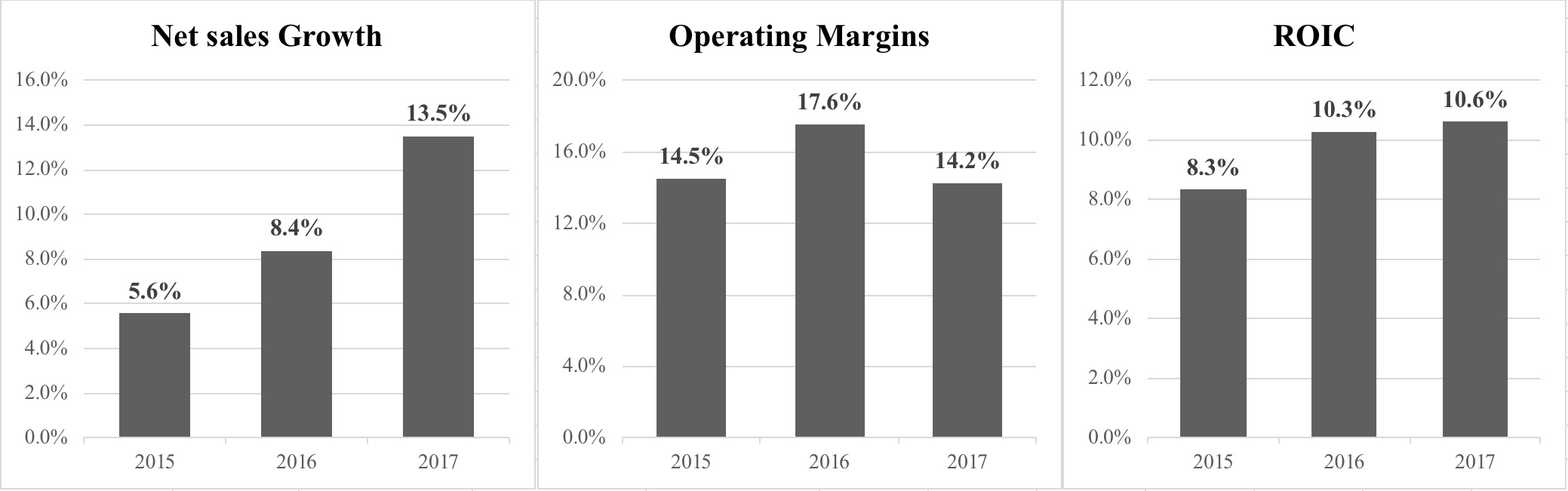

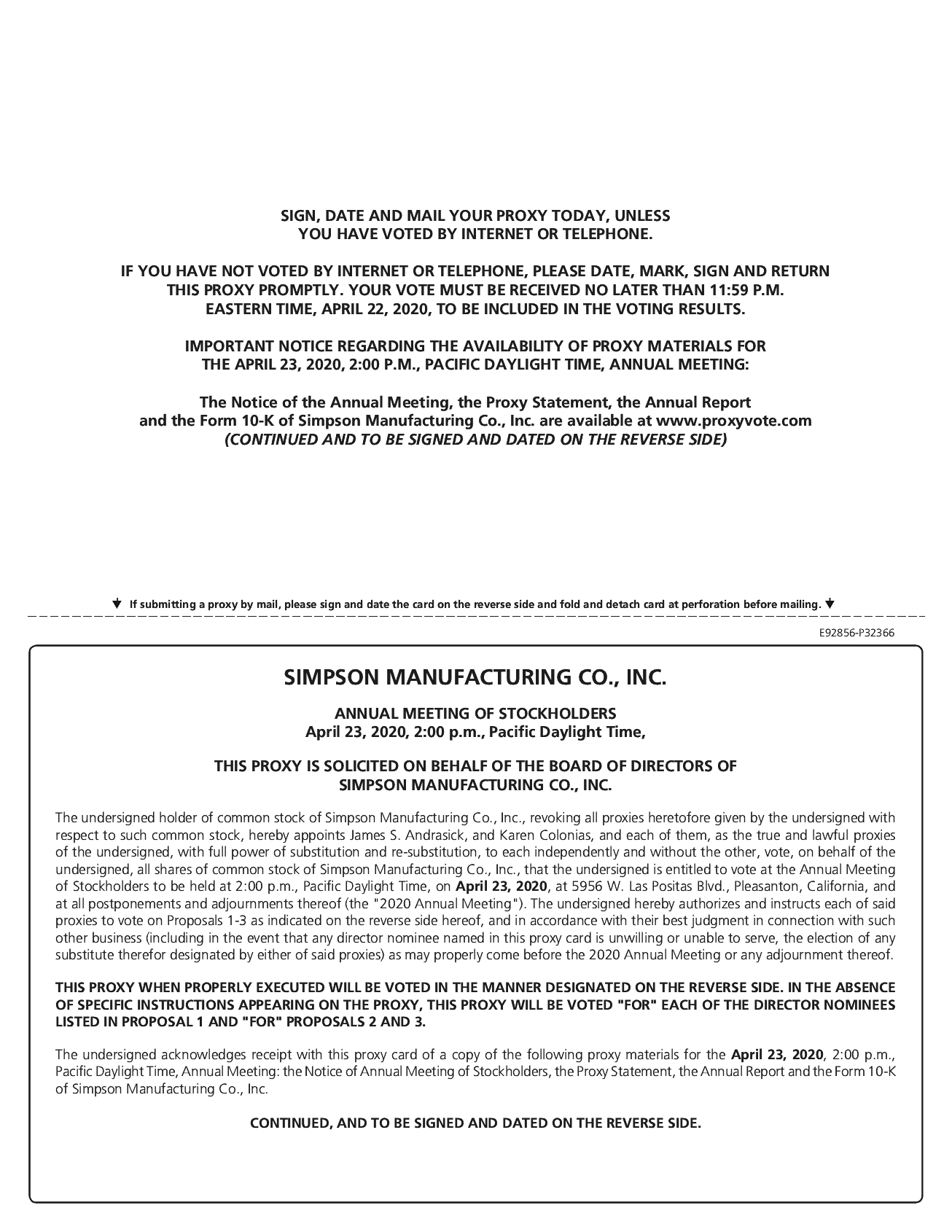

Thank you for your continued investment in Simpson Manufacturing. IManufacturing Co., Inc. (the “Company”, “Simpson”, “we” or “us”). We cordially invite you to attend the 2018Simpson’s 2020 Annual Meeting of ShareholdersStockholders (the “2018 Annual“Annual Meeting”) of Simpson Manufacturing Co., Inc. (the “Company” or “Simpson”), to be held at 2:00 p.m., Pacific Daylight Time, on Tuesday,Thursday, April 24, 2018,23, 2020, at our home offices located at 5956 W. Las Positas Blvd.,Boulevard, Pleasanton, California 94588. We are pleased to report a year of strong performance for our shareholders,stockholders, customers and employees, and we remain committed to positioning Simpson for long-term, sustainable and increasing profitable growth. To this end, in 2019 we achieved consolidated full-year net sales of approximately $1.14 billion, up 5.4% from $1.08 billion in 2018, and produced strong earnings of $2.98 per diluted share, an increase of 9.6% year-over-year. In line with these objectives, in the last quarter of 2017,addition, we announced our 2020 Plan which we believe will create substantial value for all shareholders of Simpson and provides additional transparency into our strategies and financial objectives. Our 2020 Plan is centered on three key operational objectives: (1)delivered a continued focus on our organic growth, (2) a rationalization of our cost structure to improve company-wide profitability, and (3) anyear-over-year improvement of 100 basis points in our working capital management primarily through the reductionoperating expenses as a percentage of inventory levels, increasing the speed at which we collect accounts receivablenet sales while simultaneously strengthening our position in both wood and better executing on our vendor payment terms. Our management team is focused on delivering on this plan and over the coming quarters, will provide additional updates on our success and progress against the plan.concrete products. Our proxy statementProxy Statement is an opportunity to reflect on ourthe Company’s performance, highlight the strengths and efforts of our Board and provide transparency into our corporate governance, sustainability and executive compensation practices. Our Board has a long-standing history of being overseen by independent directors with a diverse set of skills and experiences. We are very proud that 87 out of 98 directors will be independent and over 44%50% of our directors will be female if all of the Board nominees are elected at the 2018 Annual Meeting. Our Board values shareholder inputThe accompanying Proxy Statement further highlights key activities and prioritizes facilitating ongoingaccomplishments in 2019 and open shareholder engagement. In 2017, Peter Louras,contains information on the Chairman of our Board, and I have actively engaged with numerous shareholders on matters of corporate governance, executive compensation and related matters. Overall,that we were pleased withare seeking your vote at the positive feedback we received and recognition from shareholders that their previous feedback has been an integral component of manyAnnual Meeting. On behalf of the corporate governanceBoard, our executive management team, and executive compensation changesthe entire Simpson organization, thank you for your continued interest and support.

Sincerely yours, Karen Colonias

President and Chief Executive Officer James Andrasick

Independent Chair of the Board has approved over the past two years as described below.

Corporate Governance Changes:March 11, 2020

DeclassifiedYOUR VOTE IS IMPORTANT.

Whether or not you plan to attend the Board: The Board has demonstrated its accountabilitymeeting, please take a few minutes now to shareholders by declassifying the Board and requiring directors to stand for election annually through a phased-in process which begun at the 2017 Annual Meeting.vote your shares.

Removed Cumulative Voting: The Board eliminated the ability to exercise cumulative voting in director elections that could create unequal voting rights among our shareholders so that our shareholders

TABLE OF CONTENTS NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS | | DATE

Thursday, April 23, 2020 | | | TIME

2:00 p.m., Pacific Time | | | PLACE

5956 W. Las Positas Boulevard

Pleasanton, California 94588

| | | RECORD DATE

February 25, 2020 |

Record Date and Voting You are entitled to voting rights in proportion to their economic interest under a one-share, one-vote standard. Moreover, in any uncontested election of directors, each of the Board nominees currently needs to receive more “FOR” votes than “AGAINST” votes in order to be elected to the Board. Adopted Proxy Access: Our shareholders who have owned 3% of Simpson’s shares for three years have the ability via proxy access to nominate directors to appear on the management ballot at shareholder meetings.

Eliminated Shareholder Rights Plan: The Board approved the termination of the Company’s shareholder rights plan in 2016.

Executive Compensation Changes

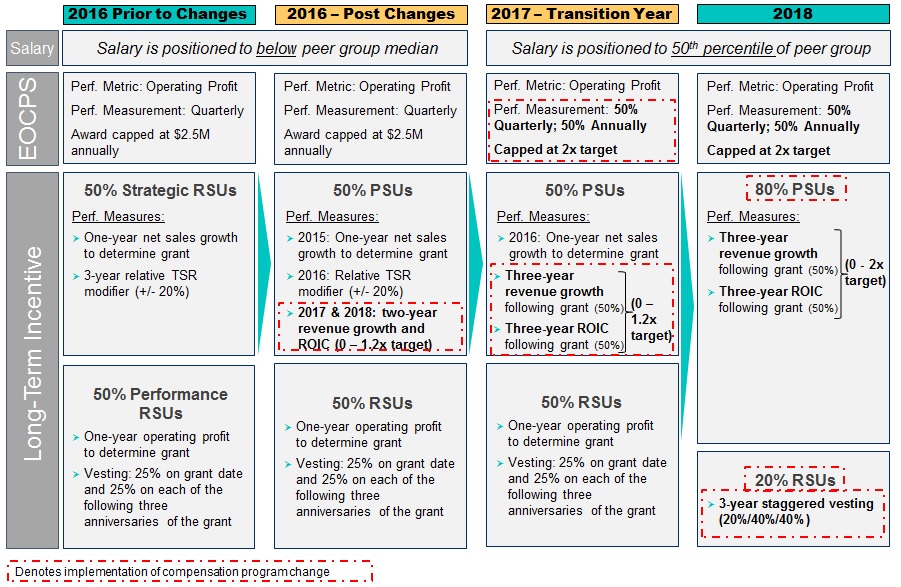

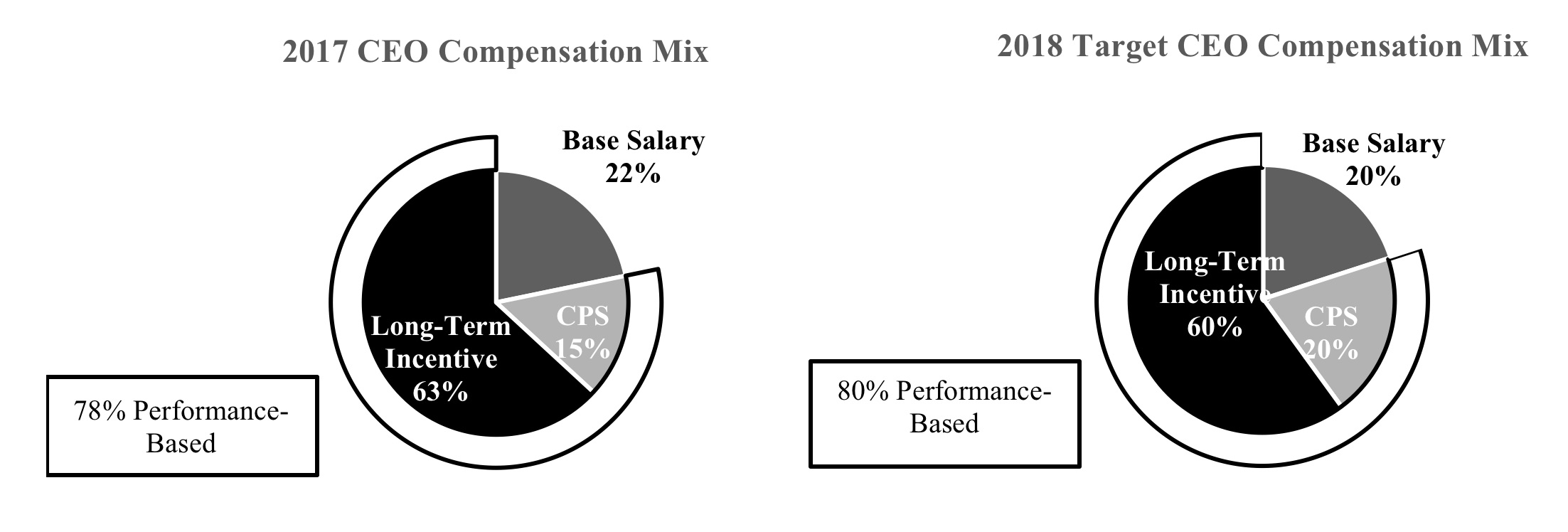

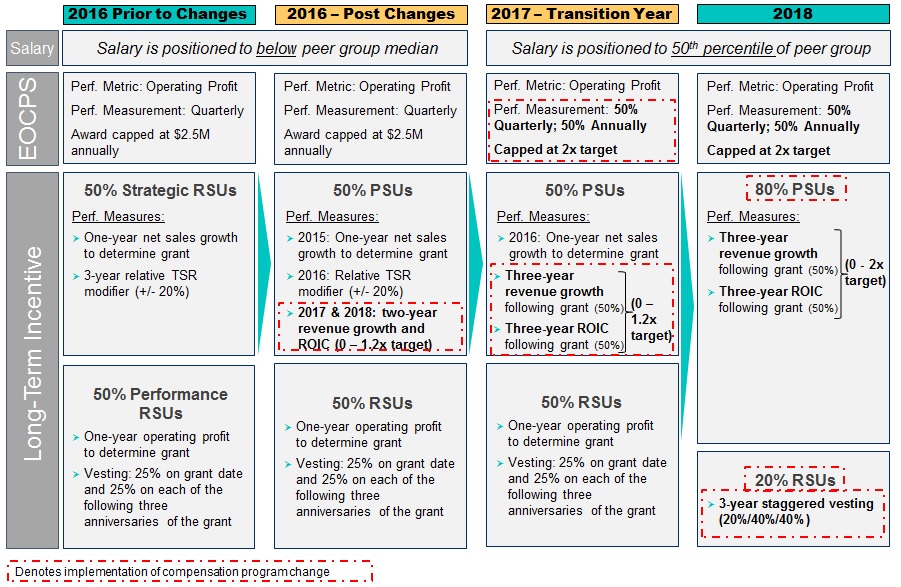

Transformed Executive Compensation Program: Following an extensive shareholder outreach in direct response to shareholder feedback, internal research and consultation with Mercer, in 2017, the Board approved significant changes to and a major transformation of our executive compensation programs.

Approved Compensation Risk Management Policies: In 2016, the Board approved a number of robust policies to enhance our compensation risk management practices, including a claw-back policy and an anti-hedging and anti-pledging policy.

Our Board values shareholder feedback and is committed to being effective stewards of shareholder capital. The accompanying materials include the Notice of Annual Meeting of Shareholders and Proxy Statement for the 2018 Annual Meeting, which provide detailed information about the matters to be considered by shareholdersvote at the 2018 Annual Meeting.

| | | | | | Very truly yours, | | | | | | Brian J. Magstadt | | | Secretary |

Pleasanton, California

March 13, 2018

The enclosed Notice of Annual Meeting of Shareholders and Proxy Statement are first being made available to shareholders of record as of February 26, 2018 on or about March 13, 2018.

SIMPSON MANUFACTURING CO., INC.

5956 W. Las Positas Blvd.

Pleasanton, California 94588

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on April 24, 2018

To the Shareholders of Simpson Manufacturing Co., Inc.:

NOTICE IS HEREBY GIVEN that the 2018 (the “Company,” “Simpson,” “we” or “us”) 2020 Annual Meeting of ShareholdersStockholders (the “2018“Annual Meeting”) if you were a stockholder of record at the close of business on February 25, 2020 (the “Record Date”). Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at the Annual Meeting”)Meeting. There were 44,365,526 shares of Simpson Manufacturing (the “Company” or “Simpson”) will be held at 2:00 p.m., Pacific Daylight Time,our common stock outstanding on Tuesday, April 24, 2018, at our home offices located at 5956 W. Las Positas Blvd., Pleasanton, California, 94588 for the following purposes, as more fully described in the accompanying proxy statement:Record Date.

Items of Business | | 1. | To elect six directors,eight members to our Board of Directors, each to hold officefor a term extending until the next annual meeting or until his or her successor has been duly elected and qualified (“Proposal 1”);our 2021 Annual Meeting of Stockholders. |

| To conduct an advisory vote to approve named executive officer compensation. |

2. | To ratify the Board’s selectionour Audit and Finance Committee’s appointment of Grant Thornton LLP as the Company’sour independent registered public accounting firm for 2018 (“Proposal 2”);the year ending December 31, 2020. |

| | 3. | To approve, on an advisory, non-binding basis, the compensation of the Company’s named executive officers (“Proposal 3”); and |

| | 4. | To transact such other business that properly broughtcomes before the 2018 Annual Meeting in accordance with the provisions of our Certificate of Incorporation and Bylaws.meeting or any adjournment thereof. |

OnlyNotice and Access

Instead of mailing a printed copy of our shareholdersproxy materials, including our Annual Report to Stockholders and Annual Report on Form 10-K, to each stockholder of record, we are providing access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all stockholders. Accordingly, on March 13, 2020, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of February 26, 2018 are entitled to notice ofthe Record Date, and will be entitled to vote atpost our proxy materials on the 2018 Annual Meeting or any postponement or adjournment thereof. Such shareholders are urged to submit a proxy card as enclosed, even if your shares were sold after such date. If your brokerage firm, bank, broker-dealer or other similar organization is the holder of record of your shares (i.e., your shares are heldwebsite referenced in “street-name”), you will receive voting instructions from the holder of record. You must follow these instructions in order for your shares to be voted. We recommend that you instruct your broker or other nominee, by following those instructions, to vote your shares for the enclosed proxy card. The accompanying materials include the Notice (www.proxyvote.com). As more fully described in the Notice, all stockholders may choose to access our proxy materials on the website referred to in the Notice and/or may request a printed set of

our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Attending the Annual Meeting See page 61 “Questions and Answers About the Annual Meeting of ShareholdersStockholders and Voting” for details. Proxy Statement for the 2018 Annual Meeting, which provide detailed information about the matters to be considered by shareholders at the 2018 Annual Meeting. ItVoting Your vote is important thatimportant. Please vote via proxy promptly so your shares can be represented, at the 2018 Annual Meeting whether or not you are personally able to attend. Even if you plan to attend the 2018 Annual Meeting, we hope that you will read the enclosed Notice of Annual Meeting of Shareholders and Proxy Statement and the voting instructions on the enclosed proxy card. We urge you to vote by completing, signing and dating the proxy card and mailing it in the enclosed, postage pre-paid envelope, or vote by telephone or the Internet by following the instructions on the proxy card. If your shares are not registered in your own name and you would like to attend the 2018 Annual Meeting, please ask the broker, bank or other nominee that holds the shares to provide you with evidence of your share ownership. THE BOARD UNANIMOUSLY RECOMMENDS A VOTEFORTHE ELECTION OF EACH OF THE BOARD’S NOMINEES ON PROPOSAL 1 USING THE ENCLOSED PROXY CARD.

THE BOARD UNANIMOUSLY RECOMMENDS VOTINGFORPROPOSALS 2 AND 3.

All shareholders are cordially invited to attend the 2018 Annual Meeting in person. In accordance with our security procedures, all persons attending the 2018 Annual Meeting will be required to present a form of government-issued picture identification. If you hold your shares in “street-name”, you must also provide proof of ownership (such as recent brokerage statement). If you are a holder of record and attend the 2018 Annual Meeting, you may vote by ballot in person even if you have previously returned your proxy card. If you hold your shares in “street-name” and wish to vote in person, you must provide a “legal proxy” from your bank or broker.

Please note that, even if you plan to attend the 2018Annual Meeting. You can vote by Internet, by telephone or by requesting a printed copy of the proxy materials and using the proxy card enclosed with the printed materials.

| | By Internet

www.proxyvote.com | | | |

| | By Telephone

Toll-free 1-800-690-6903 | | | |

| | By Mail

Follow instructions on your proxy card | | | |

The Proxy Statement, Annual Report to Stockholders and Annual Report on Form 10-K are available on the Internet at www.proxyvote.com. The following information applicable to the Annual Meeting we recommendmay be found in the Proxy Statement and accompanying proxy card: • The date, time and location of the Annual Meeting; • A list of the matters intended to be acted on and our recommendations regarding those matters; • Any control/identification numbers that you vote usingneed to access your proxy card; and • Information about attending the enclosed proxy card prior tomeeting and voting in person. By Order of the 2018Board of Directors, Terry Hammons

Secretary

March 11, 2020 Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to ensure that your shares will be represented.Be Held on April 23, 2020.

| 2020 Proxy Statement | | | | | | BY ORDER OF THE BOARD OF DIRECTORS, | | | | | | | Brian J. Magstadt | | | Secretary| 1 |

Pleasanton, California

IMPORTANT

TO ASSURE THAT YOUR SHARES ARE REPRESENTED AT THE 2018 ANNUAL MEETING, WE URGE YOU TO COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED, OR VOTE BY TELEPHONE OR THE INTERNET AS INSTRUCTED ON THE PROXY CARD, WHETHER OR NOT YOU PLAN TO ATTEND THE 2018 ANNUAL MEETING. YOU CAN REVOKE YOUR PROXY AT ANY TIME BEFORE THE PROXIES YOU APPOINTED CAST YOUR VOTES.

CONTENTSThe Notice of Annual Meeting of Shareholders and the attached Proxy Statement are first being made available to shareholders of record as of February 26, 2018 on or about March 13, 2018.

TABLE OF CONTENTS | | 1 | | | CORPORATE GOVERNANCE AND BOARD HIGHLIGHTS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2 | | | THE BOARD’S ROLE AND RESPONSIBILITIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3 | | | EXECUTIVE COMPENSATION | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2 | | | | | | | 2020 Proxy Statement |

TABLE OF CONTENTS | | 4 | | | AUDITOR

AND AUDIT COMMITTEE MATTERS | | | | | | | | | | | | | | | | | | | | | | | | | 5 | | | STOCK OWNERSHIP INFORMATION | | | | | | | | | | | | | | | | | | | | | | | | | 6 | | | OTHER INFORMATION | | | | | | 1 | | | ANNUAL MEETING PROCEDURES | | 6 | FORWARD-LOOKING STATEMENTS | | 9 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 11 | PROPOSAL 1 ELECTION OF DIRECTORS | | 13 | BOARD INFORMATION AND PRACTICES | | 19 | BOARD COMMITTEES | | 23 | CORPORATE GOVERNANCE | | 28 | PROPOSAL 2 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 30 | PROPOSAL 3 ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | | 31 | EXECUTIVE OFFICERS | | 32 | EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS | | 33 | EXECUTIVE COMPENSATION SUMMARY | | 33 | EXECUTIVE COMPENSATION ANALYSIS | | 39 | SUMMARY COMPENSATION TABLE | | 52 | DIRECTOR COMPENSATION | | 58 | CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | 59 | WHERE YOU CAN FIND MORE INFORMATION | | 61 | OTHER BUSINESS | | 61 | SHAREHOLDER PROPOSALS AND PROXY ACCESS NOTICES | | 61 | ANNUAL REPORT ON FORM 10-K | | 62 |

i2020 Proxy Statement | | | | | | | 3 |

TABLE OF CONTENTS This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully. As used in this Proxy Statement, unless the context otherwise indicates or requires, references to “Simpson,” the “Company,” “we,” “us,” and “our” mean Simpson

SIMPSON MANUFACTURING CO.Manufacturing Co., INC.

5956 W. Las Positas Blvd.

Pleasanton, California 94588

PROXY STATEMENT

ForInc. and its consolidated subsidiaries. We will first send and/or make available this Proxy Statement and the form of proxy for our 2020 Annual Meeting of Shareholders

To Be Held on April 24, 2018

March 13, 2018

This proxy statementStockholders (the “Proxy Statement”“Annual Meeting”) is being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of Simpson Manufacturing Co., Inc. (the “Company” or “Simpson”), to be held at 2:00 p.m., Pacific Daylight Time, on Tuesday, April 24, 2018, at our home offices located at 5956 W. Las Positas Blvd., Pleasanton, California, 94588, and at any postponement or adjournment thereof (the “2018 Annual Meeting”). The 2018 Annual Meeting is being held for the purposes set forth in this Proxy Statement. This Proxy Statement, the enclosed proxy card, and the Annual Report to Shareholders on Form 10-K for the fiscal year ended December 31, 2017 are first being mailed to shareholders of record as of February 26, 2018stockholders on or about March 13, 2018.2020.

Holders

ITEM 1

ELECTION OF DIRECTORS The Board of Directors (the “Board”) has nominated 8 candidates, each for a term extending until our common stock at the close2021 Annual Meeting of business on February 26, 2018 will be entitled to vote at the 2018 Annual Meeting. Shareholders are entitled to oneStockholders, and recommends that stockholders vote for each share of common stock held. The presence of holders of our common stock having a majority of the votes that could be cast by the holders of all outstanding shares of our common stock entitled to vote at the 2018 Annual Meeting, in person or represented by proxy, will constitute a quorum for the transaction of business at the 2018 Annual Meeting.nominee based on their specific background, experience, qualifications, attributes and skills. We have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a Notice of Annual Meeting of Shareholders, a proxy card and the Annual Report to Shareholders on Form 10-K for the fiscal year ended December 31, 2017, and by notifying you of the availability of our proxy materials on the Internet. The Notice of Annual Meeting of Shareholders, Proxy Statement, proxy card and Annual Report to Shareholders on Form 10-K for the Company’s fiscal year ended December 31, 2017 are available at http://materials.proxyvote.com/829073. In accordance with rules of the Securities and Exchange Commission (the “SEC”), the materials on this website are searchable, readable and printable, and the website does not have “cookies” or other tracking devices which identify visitors.

Each of the terms “we,” “our,” “us” and similar terms used in this Proxy Statement refer collectively to Simpson Manufacturing Co., Inc., a Delaware corporation and its wholly-owned subsidiaries, including Simpson Strong-Tie Company Inc., unless otherwise stated.“$” signs appearing in this Proxy Statement represent U.S. dollars, unless otherwise stated.

QUESTIONS AND ANSWERS ABOUT THE 2018 Annual Meeting

Why am I receiving this Proxy Statement?

At the 2018 Annual Meeting, the Company asks you to vote on four proposals:

| | | 1.The Board recommends a vote FOR each director nominee. | to elect six directors, each to hold office until the next annual meeting or until his or her successor has been duly elected and qualified (“Proposal 1”); |

| | | 2. | to ratify the Board’s selection of Grant Thornton LLP as the Company’s independent registered public accounting firm for the current fiscal year (“Proposal 2”); |

| | 3. | to approve, on an advisory, non-binding basis, the compensation of the Company’s named executive officers (“Proposal 3”); and |

| | 4. | to transact such other business properly brought before the 2018 Annual Meeting in accordance with the provisions of our Certificate of Incorporation and Bylaws. |

The Board may also ask you to participate in the transaction of any other business that is properly brought before the 2018 Annual Meeting in accordance with the provisions of our Certificate of Incorporation, as amended (the “Certificate of Incorporation”)Directors Skills and Bylaws, as amended (the “Bylaws”).

You are receiving this Proxy Statement as a shareholder of Simpson as of February 26, 2018, the record date for purposes of determining the shareholders entitled to receive notice of and vote at the 2018 Annual Meeting. As further described below, we request that you promptly use the enclosed proxy card to vote, by Internet, by telephone or by mail.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTEFORTHE ELECTION

OF EACH OF THE BOARD’S NOMINEES ON PROPOSAL 1 USING THE

ENCLOSED PROXY CARD.

THE BOARD UNANIMOUSLY RECOMMENDS VOTINGFORPROPOSALS 2 AND 3.

When will the 2018 Annual Meeting be held?

The 2018 Annual Meeting is scheduled to be held at 2:00 p.m., Pacific Daylight Time, on Tuesday, April 24, 2018, at our home offices located at 5956 W. Las Positas Blvd., Pleasanton, California, 94588.

Who is soliciting my vote?

In this Proxy Statement, the Board is soliciting your vote.

How does the Board recommend that I vote?

The Board unanimously recommends that you vote by proxy using the proxy card with respect to the proposals, as follows:

FOR the election of all six Board nominees set forth on the proxy card (Proposal 1);

FOR the ratification the Board’s selection of Grant Thornton LLP as the Company’s independent registered public accountants for the current fiscal year (Proposal 2); and

FOR the approval, on an advisory, non-binding basis, of the compensation of the Company’s named executive officers (Proposal 3).

Why is the Board recommending FOR the election of each of the Board’s nominees on Proposal 1 and FOR Proposals 2 and 3?

We describe all proposals and the Board’s reasons for nominating each of the Board’s nominees on Proposal 1 and for supporting Proposals 2 and 3 in detail beginning at page 13 of this Proxy Statement.

Who can vote?

Holders of our common stock at the close of business on February 26, 2018 may vote at the 2018 Annual Meeting.

As of February 26, 2018, the record date for the 2018 Annual Meeting, there were 46,684,831 shares of our common stock outstanding, each entitled to one vote, and there were approximately 9,283 shareholders of record.

How do I vote if I am a record holder?

You can vote by attending the 2018 Annual Meeting and voting in person, or you can vote by proxy. If you are the record holder of your stock, you can vote by proxy in three ways:

By Internet: You may vote by submitting a proxy over the Internet. Please refer to the proxy card or voting instruction form provided to you by your broker for instructions of how to vote by Internet.Expertise

By Telephone: Shareholders located in the United States that receive proxy materials by mail may vote by submitting a proxy by telephone by calling the toll-free telephone number on the proxy card or voting instruction form and following the instructions.

By Mail: If you received proxy materials by mail, you can vote by submitting a proxy by mail by marking, dating, signing and returning the proxy card in the postage-paid envelope.

In Person at the 2018 Annual Meeting: If you attend the 2018 Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which we will provide to you at the meeting. You are encouraged to complete, sign and date the proxy card and mail it in the enclosed postage pre-paid envelope regardless of whether or not you plan to attend the 2018 Annual Meeting.

How do I vote if my common shares are held in “street name”?

If you hold your shares of common stock in “street name,” meaning such shares are held for your account by a broker or other nominee, then you will receive instructions from such institution or person on how to vote your shares. Your broker or other nominee may allow you to deliver your voting instructions via the Internet and may also permit you to submit your voting instructions by telephone.

If you do not provide voting instructions to your broker or other nominee holding shares of our common stock for you, your shares will not be voted with respect to Proposals 1 and 3, as they are “non-discretionary” proposals under rules of the New York Stock Exchange (“NYSE”). We therefore encourage you to provide voting instructions on a proxy card as enclosed or a provided voting instruction form to your bank or other nominee that holds your shares by carefully following the instructions provided in such institution’s or person’s notice to you.

How many votes do I have?

Shareholders are entitled to one vote for each share of common stock held. See “Required Vote” below.

How will my shares of common stock be voted?

The shares of common stock represented by any proxy card which is properly executed and received by the Company prior to or at the 2018 Annual Meeting will be voted in accordance with the specifications you make thereon. Where a choice has been specified on the proxy card with respect to the proposals, the shares represented by the proxy will be voted in accordance with the specifications. If you return a validly executed proxy card without indicating how your shares should be voted on a matter and you do not revoke your proxy, your proxy will be voted: FOR the election of all six Board nominees set forth on the enclosed proxy card (Proposal 1); FOR the ratification the Board’s selection of Grant Thornton LLP as the Company’s independent registered public accountants for the current fiscal year (Proposal 2); and FOR the approval, on an advisory, non-binding basis, of the compensation of the Company’s named executive officers (Proposal 3).

Can shareholders still exercise proxy access rights for including their director nominees in the Company’s proxy materials for the 2018 Annual Meeting as of the date of this Proxy Statement?

No. The Board amended our Bylaws in 2017 to provide proxy access to qualifying shareholders for their director nominees. Pursuant to the amended Bylaws, however, notices for submitting nominees for election to the Board and being included in the Company’s proxy materials for the 2018 Annual Meeting, including this Proxy Statement, pursuant to the proxy access provision of our Bylaws must be received by our Secretary, at our principal executive office located at 5956 W. Las Positas Blvd., Pleasanton, California, 94588, no later than the close of business on December 12, 2017 (the 120th day immediately before April 11, 2018, the first anniversary of the date when our definitive proxy statement was first sent to shareholders in connection with our 2017 annual meeting). As of December 12, 2017, we had not received any such notice. Because the notice period for exercising proxy access rights has already passed for the 2018 Annual Meeting, which is to held on April 24, 2018 (not more than 30 days before or 60 days after April 11, 2018) and we announced the date of 2018 Annual Meeting at least 100 days prior to the meeting date as part of our Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, as of the date of this Proxy Statement, shareholders are no longer able to exercise proxy access rights for the 2018 Annual Meeting.

Can shareholders still propose business to be considered at the 2018 Annual Meeting as of the date of this Proxy Statement?

No. Pursuant to our Bylaws, at an annual meeting of shareholders, only such business shall be conducted as shall have been properly brought before the meeting. As we publicly disclosed the date of the 2018 Annual Meeting to be April 24, 2018 at least 85 days prior to such meeting date, for any business to be properly brought before the annual meeting by a shareholder, the shareholder must have given timely notice in writing to our Secretary at our principal executive offices located at 5956 W. Las Positas Blvd., Pleasanton, California, 94588, not less than 75 days prior to the meeting. As of February 8, 2018, we had not received any such notice. Because the period for shareholders to present business for consideration at the 2018 Annual Meeting has already passed, as of the date of this Proxy Statement, only the Board may propose business to be considered at the 2018 Annual Meeting.

Why is the election of directors at the 2018 Annual Meeting considered an uncontested election?

Pursuant to our Bylaws, as we publicly disclosed the date of the 2018 Annual Meeting to be April 24, 2018 at least 85 days prior to such meeting date, nominations for director elections (other than pursuant to the proxy access provision of our Bylaws) by shareholders for election at the 2018 Annual Meeting must be received by our Secretary, at our principal executive offices located at 5956 W. Las Positas Blvd., Pleasanton, California, 94588, not less than 75 days prior to the meeting. As of February 8, 2018, we had not received any such nomination. Because the period for shareholders to nominate director candidates for election

at the 2018 Annual Meeting has already passed, as of the date of this Proxy Statement, the six director candidates nominated by the Board are the only nominees for election to the Board at the 2018 Annual Meeting.

When will declassification of the Board be complete?

At the March 28, 2017 special meeting of the shareholders, our shareholders approved and adopted an amendment to the Company’s Certificate of Incorporation to declassify the Board over a three-year period and provide that directors who are up for election be elected for one-year terms beginning at the 2017 annual meeting of the shareholders. Declassification of the Board therefore is phased-in over a period of three years beginning with the 2017 annual meeting and concluding at the 2019 annual meeting of shareholders. Directors elected at or after the 2017 annual meeting are elected to one-year terms expiring at the next annual meeting of shareholders following their election. Directors elected to the Board before the 2017 annual meeting will complete the remainder of their respective three-year terms. As a result, declassification of the Board will be complete as of the 2019 annual meeting of shareholders, and going forward, all members of the Board will serve one-year terms.

What vote is required with respect to the proposals?

Pursuant to our Bylaws, in an uncontested election, directors are elected by the affirmative vote of a majority of the votes cast. Under this majority voting standard, each of the six director nominees on Proposal 1 will be elected if he or she receives more “FOR” votes than “AGAINST” votes, with broker non-votes and abstentions not counted as votes cast either “FOR” or “AGAINST” the nominee. The enclosed proxy card enables a shareholder to vote “FOR,” “AGAINST” or “ABSTAIN” as to each person nominated by the Board.

Proposals 2 and 3 will be decided by the affirmative vote of a majority of the votes cast. The enclosed proxy card enables a shareholder to vote “FOR,” “AGAINST” or “ABSTAIN” on these proposals. Each of Proposals 2 and 3 will pass if the total votes cast “for” a given proposal exceed the total number of votes cast “against” such given proposal.

What is the effect of abstentions and broker non-votes on voting?

Abstentions by shareholders from voting and broker non-votes will be counted towards determining whether or not a quorum is present. However, because abstentions and broker non-votes do not count as affirmative or negative votes cast, they will not affect the outcome of the vote of any proposal at the 2018 Annual Meeting, except where brokers or other nominees may exercise their discretion on “discretionary” proposals.

With respect to the 2018 Annual Meeting, Proposal 2 to ratify the appointment of our independent registered public accountants is considered a “discretionary” proposal under rules of the NYSE for which your broker or other nominee does not need your voting instruction in order to vote your shares. In contrast, your broker or other nominee will not have discretion to vote on Proposals 1 and 3 absent voting instructions from you, as they are “non-discretionary” proposals.

If you hold your shares in “street-name” through a broker or other nominee, absent voting instructions from you, your shares will not be counted as voting and will have no effect on those proposals requiring shareholder approval. Therefore, you are urged to instruct your broker or other nominee to submit a proxy card as enclosed or vote by telephone or the internet as instructed on the proxy card.

If I have already voted by proxy against the proposals, can I still change my mind?

Yes. To change your vote by proxy, simply sign, date and return the enclosed proxy card or voting instruction form in the accompanying postage-paid envelope, or vote by proxy by telephone or via the Internet in accordance with the instructions in the proxy card or voting instruction form. We strongly urge you to vote by proxy FOR the election of each of the Board’s six nominees on Proposal 1 and FOR Proposals 2 and 3. Only your latest dated proxy will count at the 2018 Annual Meeting.

Will my shares be voted if I do nothing?

If your shares of our common stock are registered in your name, you must sign and return a proxy card in order for your shares to be voted, unless you vote over the Internet or by telephone or attend the 2018 Annual Meeting and vote in person.

If your shares of common stock are held in “street name,” that is, held for your account by a broker or other nominee, and you do not instruct your broker or other nominee how to vote your shares, then, because Proposals 1 and 2 are “non-discretionary” proposals, your broker or other nominee would only have discretionary authority to vote your shares on Proposal 3 but not on other proposals. If your shares of our common stock are held in “street name,” your broker or other nominee should have provided you a proxy card as enclosed or a voting instruction form with this Proxy Statement. We strongly encourage you to authorize your broker or other nominee to vote your shares by following the instructions provided on the proxy card or voting instruction form.

Please return your proxy card or voting instruction form to your broker or other nominee. Please contact the person responsible for your account to ensure that a proxy card or voting instruction form is voted on your behalf.

We strongly urge you to vote by proxy FOR the election of each of the Board’s nominees on Proposal 1 and FOR Proposals 2 and 3, by signing, dating and returning the enclosed proxy card in the envelope provided. You may also vote by proxy over the Internet using the Internet address on the proxy card or by telephone using the toll-free number on the proxy card. If your shares are held in “street name,” you should follow the instructions on your proxy card or voting instruction form provided by your broker or other nominee and provide specific instructions to your broker or other nominee to vote as described above.

What constitutes a quorum?

The presence of holders of our common stock having a majority of the votes that could be cast by the holders of all outstanding shares of our common stock entitled to vote at the 2018 Annual Meeting, in person or represented by proxy, will constitute a quorum for the transaction of business at the 2018 Annual Meeting.

Votes withheld, abstentions and broker non-votes, if any, will be counted as present or represented for purposes of determining the presence or absence of a quorum for this meeting. In the absence of a quorum, the 2018 Annual Meeting may be adjourned by a majority of the votes entitled to be cast represented either in person or by proxy.

Where can I find the proxy materials for the 2018 Annual Meeting?

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2018 ANNUAL MEETING: THE PROXY STATEMENT FOR THE 2018 ANNUAL MEETING AND THE ANNUAL REPORT TO SHAREHOLDERS ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 ARE AVAILABLE FREE OF CHARGE AT HTTP://MATERIALS.PROXYVOTE.COM/829073.

ANNUAL MEETING PROCEDURES

Annual Meeting Admission

Only Simpson shareholders or their duly authorized and constituted proxies may attend the 2018 Annual Meeting. Proof of ownership of our common stock must be presented in order to be admitted to the 2018 Annual Meeting. If your shares are held in the name of a bank, broker or other holder of record and you plan to attend the 2018 Annual Meeting in person, you must bring a brokerage statement, the proxy card mailed to you by your bank or broker or other proof of ownership as of the close of business on February 26, 2018, the record date, to be admitted to the 2018 Annual Meeting. Otherwise, proper documentation of a duly authorized and constituted proxy must be presented. This proof can be: a brokerage statement or letter from a broker, bank or other nominee indicating ownership on the record date, a proxy card, or a valid, legal proxy provided by your broker, bank or other nominee.

After the chairman of the meeting announces the opening of the polls for the first matter upon which the shareholders will vote at the 2018 Annual Meeting, further entry will be prohibited. No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the 2018 Annual Meeting. All persons attending the meeting will be required to present a valid government-issued picture identification, such as a driver’s license or passport, to gain admittance to the 2018 Annual Meeting.

Who Can Vote, Outstanding Shares

Holders of record of our common stock at the close of business on February 26, 2018 may vote at the 2018 Annual Meeting.

As of February 26, 2018, the record date for the 2018 Annual Meeting, there were 46,684,831 shares of our common stock outstanding, each entitled to one vote, and there were approximately 9,283 shareholders of record.

Voting Procedures

You can vote by attending the 2018 Annual Meeting and voting in person, or you can vote by proxy. If you are the record holder of your stock, you can vote by proxy in three ways:

By Internet: You may vote by submitting a proxy over the Internet. Please refer to the proxy card or voting instruction form provided to you by your broker for instructions of how to vote by Internet.

By Telephone: Shareholders located in the United States that receive proxy materials by mail may vote by submitting a proxy by telephone by calling the toll-free telephone number on your proxy card or voting instruction form and following the instructions.

By Mail: If you received proxy materials by mail, you can vote by submitting a proxy by mail by marking, dating, signing and returning the proxy card in the postage-paid envelope.

In Person at the 2018 Annual Meeting: If you attend the 2018 Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which we will provide to you at the meeting. You are encouraged to complete, sign and date the proxy card and mail it in the enclosed postage pre-paid envelope regardless of whether or not you plan to attend the 2018 Annual Meeting.

If you hold your shares of common stock in “street name,” meaning such shares are held for your account by a broker, bank or other nominee, then you will receive instructions from such institution or person on how to vote your shares. Your broker, bank or other nominee will allow you to deliver your voting instructions via the Internet and may also permit you to submit your voting instructions by telephone.

Proxy Card

The shares represented by any proxy card which is properly executed and received by the Company prior to or at the 2018 Annual Meeting will be voted in accordance with the specifications made thereon. Where a choice has been specified on the proxy card with respect to the proposals, the shares represented by the proxy card will be voted in accordance with the specifications. If you return a validly executed proxy card without indicating how your shares should be voted on a matter and you do not revoke your proxy, your proxy will be voted: FOR the election of all six Board nominees set forth on the proxy card (Proposal 1); FOR the ratification the Board’s selection of Grant Thornton LLP as the Company’s independent registered public accountants for 2018

(Proposal 2); and FOR the approval, on an advisory, non-binding basis, of the compensation of the Company’s named executive officers (Proposal 3).

As of the date of this Proxy Statement, we are not aware of any matters that are expected to come before the 2018 Annual Meeting other than those described in this Proxy Statement. If any other matter should be presented by the Board at the 2018 Annual Meeting upon which a vote may be properly taken, shares represented by all proxy cards received by the Board will be voted with respect thereto at the discretion of the persons named as proxies in the enclosed proxy card.

Record Date

Only holders of record of common stock at the close of business on February 26, 2018 will be entitled to notice of and to vote at the 2018 Annual Meeting.

Quorum

The presence of holders of our common stock having a majority of the votes that could be cast by the holders of all outstanding shares of our common stock entitled to vote at the 2018 Annual Meeting, in person or represented by proxy, will constitute a quorum for the transaction of business at the 2018 Annual Meeting. Votes withheld, abstentions and broker non-votes, if any, will be counted as present or represented for purposes of determining the presence or absence of a quorum for this meeting. In the absence of a quorum, the 2018 Annual Meeting may be adjourned by a majority of the votes entitled to be cast represented either in person or by proxy.

Required Vote

As a holder of our common stock, you are entitled to one vote per share on any matter submitted to a vote of the shareholders.

Pursuant to our Bylaws, in an uncontested election, directors are elected by the affirmative vote of a majority of the votes cast. Under this majority voting standard, a director nominee will be elected as a director if the nominee receives the affirmative vote of a majority of the votes cast for the nominee, meaning that to be elected the number of votes cast “FOR” a nominee must exceed the number of votes cast “AGAINST” the nominee, with broker non-votes and abstentions not counted as votes cast either “FOR” or “AGAINST” the nominee.

As a result, each of the six director nominees on Proposal 1 will be elected if he or she receives more “FOR” votes than “AGAINST” votes at the 2018 Annual Meeting.

The enclosed proxy card enables a shareholder to vote “FOR,” “AGAINST” or “ABSTAIN” as to each person nominated by the Board. Abstentions and broker non-votes, if any, will not constitute votes cast or votes withheld on Proposal 1 and will accordingly have no effect on the outcome of the vote on Proposal 1. Under our Certificate of Incorporation and Bylaws, shareholders will not be able to cumulate their votes in the election of directors.

Proposals 2 and 3 will be decided by the affirmative vote of a majority of the votes cast. The enclosed proxy card enables a shareholder to vote “FOR,” “AGAINST” or “ABSTAIN” on these proposals. Any of Proposals 2 and 3 will pass if the total votes cast “for” such proposal exceed the total number of votes cast “against” the proposal.

Abstentions, if any, will not constitute votes cast on any of Proposals 2 and 3 or “for” or “against” with respect to any director nominee on Proposal 1 and will accordingly have no effect on the outcome of the vote on such proposals.

Broker non-votes, if any, will not constitute votes cast on Proposal 3 or “for” or “against” with respect to any director nominee on Proposal 1 and will accordingly have no effect on the outcome of the vote on such proposals. Since Proposal 2 to ratify the appointment of our independent registered public accountants is considered a “discretionary” proposal, your broker may vote your shares without your voting instruction.

Proposal 3 is an advisory proposal only and is not binding on the Board or the Company.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTEFORTHE ELECTION

OF EACH OF THE BOARD’S SIX NOMINEES ON PROPOSAL 1 USING THE

ENCLOSED PROXY CARD.

THE BOARD UNANIMOUSLY RECOMMENDS VOTINGFORPROPOSALS 2 AND 3.

Abstentions and Broker Non-Votes

Abstentions by shareholders from voting and broker non-votes will be counted towards determining whether or not a quorum is present. However, because abstentions and broker non-votes do not count as affirmative or negative votes cast, they will not affect the outcome of the vote of any proposal at the 2018 Annual Meeting, except where brokers may exercise their discretion on “discretionary” proposals, as discussed below.

A “broker non-vote” occurs when shares held by a broker or other nominee are not voted with respect to a particular proposal because the broker or other nominee does not have discretionary authority to vote on the matter and has not received voting instructions from its clients at least 10 days before the date of the meeting. If your bank, broker or other nominee holds your shares in its name and you do not instruct your broker or other nominee how to vote, your broker or other nominee will only have discretion to vote your shares on “discretionary” proposals.

Rules of the NYSE determine whether proposals presented at shareholder meetings are “discretionary” or “non-discretionary.” If a proposal is determined to be discretionary, your broker or other nominee is permitted under NYSE rules to vote on the proposal without receiving voting instructions from you. If a proposal is determined to be non-discretionary, your broker or other nominee is not permitted under NYSE rules to vote on the proposal without receiving voting instructions from you.

With respect to the 2018 Annual Meeting, Proposal 2 to ratify the appointment of our independent registered public accountants is considered a “discretionary” proposal under NYSE rules for which your broker or other nominee does not need your voting instruction in order to vote your shares. In contrast, your broker or other nominee will not have discretion to vote on Proposals 1 and 3 absent voting instructions from you, as they are “non-discretionary” proposals.

We encourage you to provide voting instructions on a proxy card as enclosed or a provided voting instruction form to the bank, broker, trustee or other nominee that holds your shares by carefully following the instructions provided in their notice to you.

Revocability of Proxy

A shareholder of record who has properly executed and delivered a proxy may revoke such proxy at any time before the 2018 Annual Meeting in any of the four following ways:

timely complete and return a new proxy card bearing a later date;

vote on a later date by using the Internet or telephone;

deliver a written notice to our Secretary prior to the 2018 Annual Meeting by any means, including facsimile, stating that your proxy is revoked; or

attend the meeting and vote in person.

If your shares are held of record by a bank, broker, trustee or other nominee other nominee and you desire to vote at the meeting, you may change your vote by submitting new voting instructions to your broker in accordance with such broker’s procedures.

Appraisal Rights

Holders of shares of common stock do not have appraisal rights under Delaware law in connection with this proxy solicitation.

Proxy Access

The Board amended our Bylaws on March 28, 2017 to provide proxy access to qualifying shareholders effective as of March 28, 2017. Pursuant to our amended Bylaws, the notice period for exercising proxy access rights has already passed for the 2018 Annual Meeting. As a result, as of the date of this proxy statement, our shareholders will no longer be able to exercise proxy access rights for the 2018 Annual Meeting.

Shareholder List

A list of shareholders entitled to vote at the 2018 Annual Meeting will be available for examination by any shareholder for any purpose germane to the 2018 Annual Meeting during ordinary business hours at our corporate headquarters located at 5956 W. Las Positas Blvd., Pleasanton, California, 94588, for the ten days prior to the 2018 Annual Meeting, and also will be available for examination by any shareholder at the 2018 Annual Meeting.

Communications with the Board

We encourage shareholders and interested parties to communicate any concerns or suggestions directly to the independent members of the Board, by writing to:

Board of Directors

Simpson Manufacturing Co., Inc.

P.O. Box 1394

Alamo, CA 94507-7394

Other Matters

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2018 ANNUAL MEETING: THE PROXY STATEMENT FOR THE 2018 ANNUAL MEETING AND THE ANNUAL REPORT TO SHAREHOLDERS ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 ARE AVAILABLE FREE OF CHARGE AT HTTP://MATERIALS.PROXYVOTE.COM/829073.

Persons Making the Solicitation

We are required by law to convene annual meetings of shareholders at which directors are elected. The Board is soliciting proxies from our shareholders for the 2018 Annual Meeting. United States federal securities laws require us to send you this Proxy Statement, and any amendments and supplements thereto, and to specify the information required to be contained in it. The Company will bear the expenses of calling and holding the 2018 Annual Meeting and the solicitation of proxies therefor. These costs will include, among other items, the expense of preparing, assembling, printing and mailing the proxy materials to shareholders of record and beneficial owners, and reimbursements paid to brokerage firms, banks and other fiduciaries for their reasonable out-of pocket expenses for forwarding proxy materials to shareholders and obtaining beneficial owner’s voting instructions. In addition to soliciting proxies by mail, our directors, officers and employees may solicit proxies on behalf of the Board, without additional compensation, personally or by telephone. We may also solicit proxies by email from shareholders who are our employees or who previously requested to receive proxy materials electronically.

FORWARD-LOOKING STATEMENTS

This Proxy Statement contains forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) and the Private Securities Litigation Reform Act of 1995. All statements relating to events or results that may occur in the future, including, but not limited to, the Company’s future meeting dates, board and committee members, director nominees, officers (including executive officers and named executive officers), compensation arrangements, plans or amendments (including those related to profit sharing and stock-based compensation), company policies, corporate governance practices, documents or amendments (including charter or bylaw amendments, shareholder rights plans or similar arrangements) as well as capital and corporate structure (including major shareholders, board structure and board composition), are forward-looking statements. Forward-looking statements generally can be identified by words such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “plan,” “target,” “continue,” “project,” “change,” “result,” “future,” “will,” “could,” “can,” “may,” “likely,” “potentially,” or similar expressions. Forward-looking statements are necessarily speculative in nature, are based on numerous assumptions, and involve known and unknown risks, uncertainties and other factors (some of which are beyond the Company's control) that could significantly affect the Company's operations and may cause its actual actions, results, financial condition, performance or achievements to be substantially different from any future actions, results, financial condition, performance or achievements expressed or implied by any such forward-looking statements. Those factors include, but are not limited to, (i) the impact, execution and effectiveness of the Company’s current strategic plan, the 2020 Plan, and the efforts and costs to implement the plan; (ii) general economic cycles and construction business conditions; (iii) customer acceptance of our products; (iv) product liability claims, contractual liability, engineering and design liability and similar liabilities or claims, (v) relationships with partners, suppliers and customers and their financial conditions; (vi) materials and manufacturing costs; (vii) changes in capital and credit market conditions; (viii) technological developments, including system updates and conversions; (ix) increased competition; (x) changes in laws or industry practices; (xi) litigation risks and actions by activist shareholders, (xii) changes in market conditions; (xiii) governmental and business conditions in countries where our products are manufactured and sold; (xiv) natural disasters and other factors that are beyond the

Company’s reasonable control; (xv) changes in trade regulations or U.S. and international taxes, tariffs and duties including those imposed on the Company’s income, imports, exports and repatriation of funds; (xvi) effects of merger or acquisition activities or the lack thereof; (xvii) actual or potential takeover or other change-of-control threats; (xviii) changes in our plans, strategies, objectives, assumptions, expectations or intentions; and (xix) other risks and uncertainties indicated from time to time in our filings with the U.S. Securities and Exchange Commission (the “SEC”), including, without limitation, most recently the Company’s Annual Report to Shareholders on Form 10-K for the period ended December 31, 2017, under the heading Item 1A - “Risk Factors” and the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All forward-looking statements hereunder are made as of the date of this Proxy Statement and are subject to change. Except as required by law, the Company does not intend, and undertakes no obligation to update or publicly release any revision to any such forward-looking statements, whether as a result of the receipt of new information, the occurrence of subsequent events, the change of circumstance or otherwise. We further do not accept any responsibility for any projections or reports published by analysts, investors or other third parties. Each forward-looking statement contained in this Proxy Statement is specifically qualified in its entirety by the aforementioned factors. You are hereby advised to carefully read this Proxy Statement in conjunction with the important disclaimers set forth above and are urged not to rely on any forward-looking statements in reaching any conclusions or making any investment decisions.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table provides information, as of February 26, 2018, the record date for the 2018 Annual Meeting, unless otherwise indicated, about the beneficial ownership of our common stock by -

each shareholder known by us to be the beneficial owner of more than 5% of our common stock,

each of our directors and each of our director nominees,

each of our Principal Executive Officer, our Principal Financial Officer and our three other most highly compensated executive officers (collectively, the “Named Executive Officers” or “NEOs”) as named in the Summary Compensation Table (See “Executive Compensation” below),

and all of our executive officers and directors as a group.

| | | | | | | | | Name and, for Each 5% Beneficial Owner, Address(1) | | Beneficial Ownership of Shares of Common Stock(1) | | Percent of Class(2) | | Sharon Simpson | | | | | | | 21C Orinda Way | | |

| | | |

| | Orinda, CA 94563 | | 5,111,828 |

| | | 10.7 | % | | | | | | | | | BlackRock, Inc. | | | | | | | 55 East 52nd Street | | |

| | | |

| | New York, NY 10055 | | 5,640,565 |

| (3) | | 12.1 | % | | | | | | | | | The Vanguard Group | | | | | | | 100 Vanguard Blvd. | | |

| | | |

| | Malvern, PA 19355 | | 3,689,719 |

| (4) | | 7.9 | % | | | | | | | | | Karen Colonias | | 60,361 |

| | | * |

| | | | | | | | | Brian J. Magstadt | | 25,190 |

| | | * |

| | | | | | | | | Ricardo M. Arevalo | | 13,564 |

| | | * |

| | | | | | | | | Roger Dankel | | 12,564 |

| | | * |

| | | | | | | | | James S. Andrasick | | 9,107 |

| | | * |

| | | | | | | | | Michael A. Bless | | 1,438 |

| | | * |

| | | | | | | | | Jennifer A. Chatman | | 10,532 |

| | | * |

| | | | | | | | | Gary M. Cusumano | | 16,332 |

| | | * |

| | | | | | | | | Philip E. Donaldson | | — |

| | | * |

| | | | | | | | | Celeste Volz Ford | | 7,777 |

| | | * |

| | | | | | | | | Peter N. Louras, Jr. | | 15,215 |

| | | * |

| | | | | | | | | Robin G. MacGillivray | | 10,532 |

| | | * |

| | | | | | | | All executive officers and directors as a group (12 persons) | | 182,612 |

| | | * |

|

____________

* Less than 0.5%.

(1) Information in this table is based on information that our officers and directors provided to us and on statements on Schedule 13D or 13G that shareholders filed with the SEC and sent to us. Unless otherwise indicated below in the respective footnotes, the persons named in the table had sole voting and sole dispositive power with respect to all shares beneficially owned, subject to community property laws where applicable. Pursuant to the rules of the SEC, the number of shares of our common stock below includes shares issuable upon settlement of restricted stock units held by the respective person or group that will vest within 60 days of February 26, 2018 (but not restricted stock units that will vest more than 60 days after February 26, 2018).

(2) Applicable percentage of ownership is based upon 46,684,831 shares of our common stock outstanding as of February 26, 2018.

(3) Based on the Schedule 13G/A filed by BlackRock, Inc. with the SEC on January 17, 2018, BlackRock, Inc. has sole voting power with respect to 5,558,378 shares and sole dispositive power with respect to 5,640,565 shares.

(4) Based on the Schedule 13G/A filed by The Vanguard Group with the SEC on February 7, 2018, The Vanguard Group has sole voting power with respect to 49,959 shares, shared voting power with respect to 5,500 shares, sole dispositive power with respect to 3,637,060 shares and shared dispositive power with respect to 52,659 shares.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Composition of the Board

The Board currently consists of eight members. The Board has resolved to fix its size to be nine directors as of the 2018 Annual Meeting. Information about our current Board members and the new Board director nominee as of the 2018 Annual Meeting is set forth in the table below:

| | | | | | | | | | | Name | | Age | | Director Since | | Independent | | Year Current Term Will Expire | | Philip E. Donaldson | | 55 | | N/A | | X | | Being nominated by the Board for election to the Board at the 2018 Annual Meeting. | Karen Colonias (CEO) | | 61 | | 2013 | | | | 2018 | | Celeste Volz Ford | | 61 | | 2014 | | X | | 2018 | | Michael A. Bless | | 52 | | 2017 | | X | | 2018 | | Jennifer A. Chatman | | 59 | | 2004 | | X | | 2018 | | Robin G. MacGillivray | | 63 | | 2004 | | X | | 2018 | Peter N. Louras, Jr. (Chairman of the Board) | | 68 | | 1999 | | X | | 2019 | | James S. Andrasick | | 74 | | 2012 | | X | | 2019 | | Gary M. Cusumano | | 74 | | 2007 | | X | | 2019 |

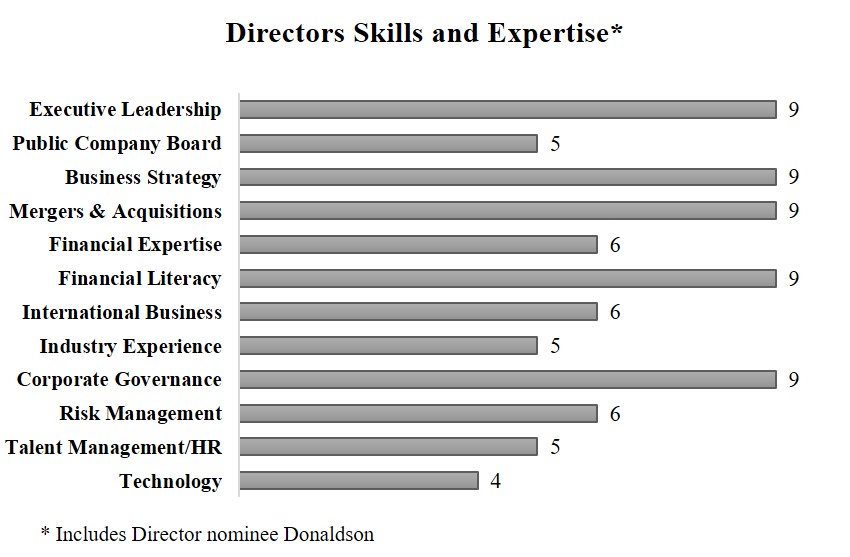

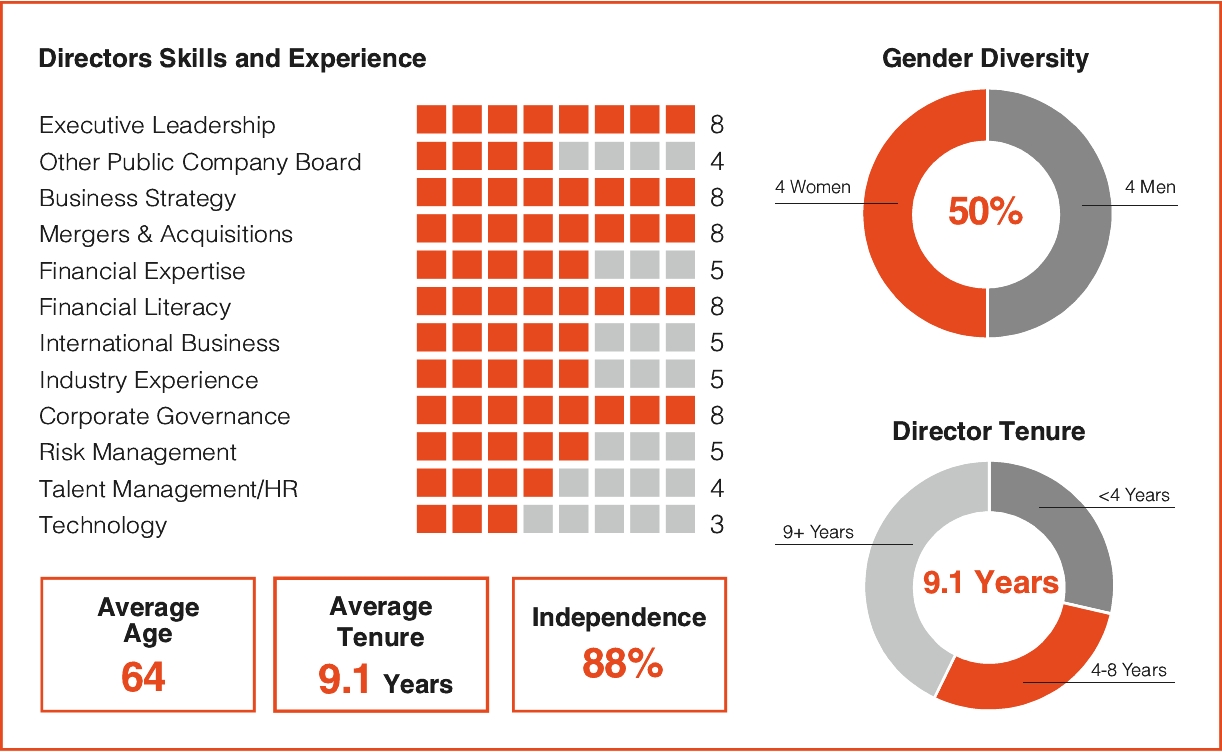

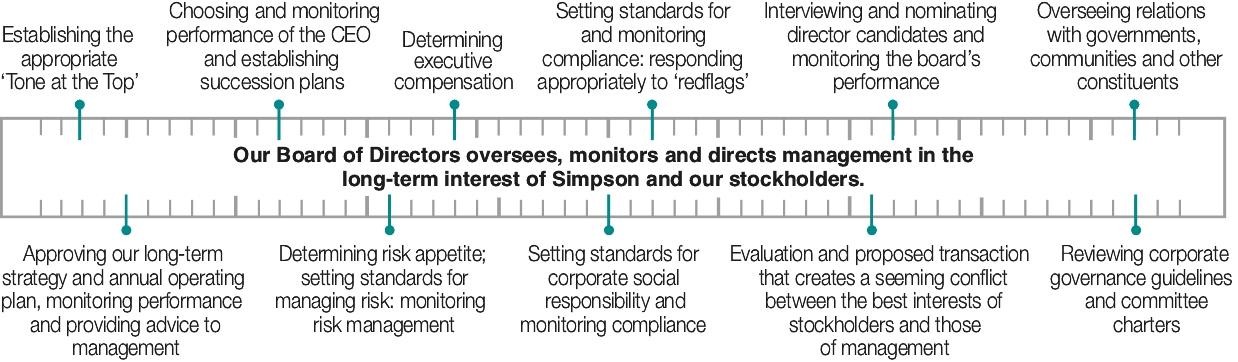

The Board is comprised of directors with strong professional reputations, skills and experience in established companies and other organizations of comparable status and size to us and/or in areas or industries relevant to our business, strategy and operations. Core skills and experiences represented by continuing memberseach of the Board and the new Board director nomineenominees are included in the summary graphic below:below. Further discussion on the qualifications and experience of director nominees is included in the “2020 Director Nominees” section of this Proxy Statement.

The current composition of the Board and its director nominees reflect director-selection criteria developed by the Nominating and Governance Committee to address theour needs and prioritiespriorities. 4 | | | | | | | 2020 Proxy Statement |

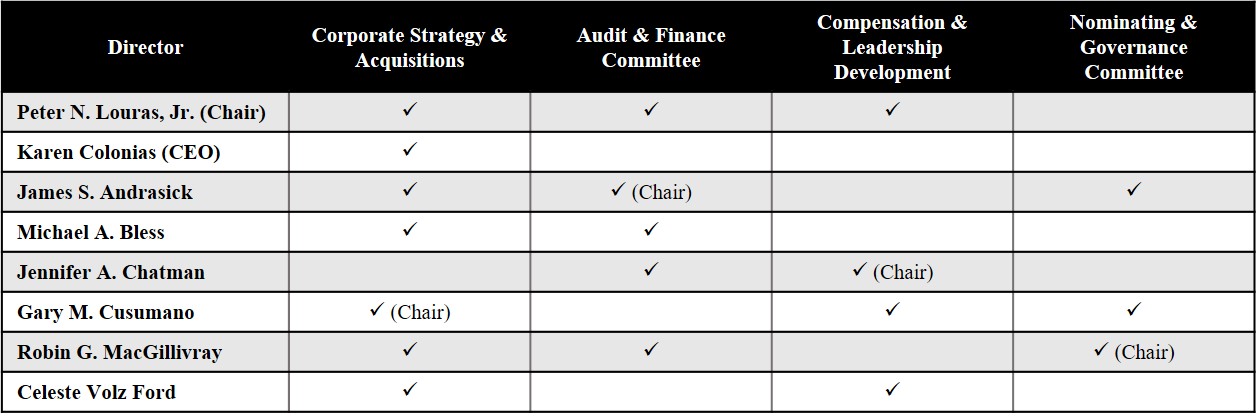

TABLE OF CONTENTS | | James S. Andrasick, Independent

Non-Executive Chair of the Board, Former Chief Executive Officer

of Matson Navigation Company, Inc. | | | 75 | | | 2012 | | | • | | | Audit and Finance | | | • | | | None | | | | • | | | Compensation and Leadership Development | | | | • | | | Corporate Strategy

and Acquisitions | | | | • | | | Nominating and Governance | | | | Michael A. Bless, Independent

Chief Executive Officer of Century Aluminum Company | | | 54 | | | 2017 | | | • | | | Audit and Finance | | | • | | | Century Aluminum Company | | | | • | | | Corporate Strategy

and Acquisitions | | | • | | | CNA Financial Corporation | | | | Jennifer A. Chatman, Independent

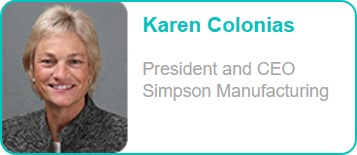

Paul J. Cortese Professor of Management, Haas School of Business, University of California Berkeley | | | 60 | | | 2004 | | | • | | | Compensation and Leadership Development | | | • | | | None | | | | • | | | Nominating and Governance (Chair) | | | | Karen Colonias,

President, Chief Executive Officer, Simpson Manufacturing Company, Inc. | | | 62 | | | 2013 | | | • | | | Corporate Strategy

and Acquisitions | | | • | | | Reliance Steel and Aluminum Co. | | | | Gary M. Cusumano, Independent

Retired Chairman, Chief Executive Officer and President of The Newhall Land and Farming Company | | | 76 | | | 2007 | | | • | | | Compensation and Leadership Development (Chair) | | | • | | | None | | | | • | | | Corporate Strategy

and Acquisitions | | | | Philip E. Donaldson, Independent

Executive Vice President & Chief Financial Officer of Andersen Corporation | | | 58 | | | 2018 | | | • | | | Audit and Finance (Chair) | | | • | | | None | | | | • | | | Corporate Strategy

and Acquisitions | | | | Celeste Volz Ford, Independent

Board Chair and Founder of Stellar Solutions | | | 63 | | | 2014 | | | • | | | Audit and Finance | | | • | | | None | | | | • | | | Corporate Strategy

and Acquisitions (Chair) | | | | • | | | Nominating and Governance | | | | Robin G. MacGillivray, Independent

Former Senior Vice President – One AT&T Integration, AT&T | | | 65 | | | 2004 | | | • | | | Compensation and Leadership Development | | | • | | | None | | | | • | | | Nominating and Governance | |

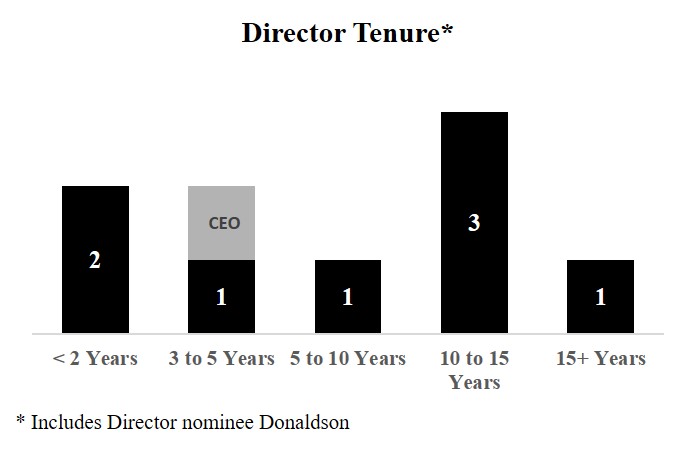

Our Board is appropriately refreshed, and our directors bring a balance of experience and fresh perspectives. 2020 Proxy Statement | | | | | | | 5 |

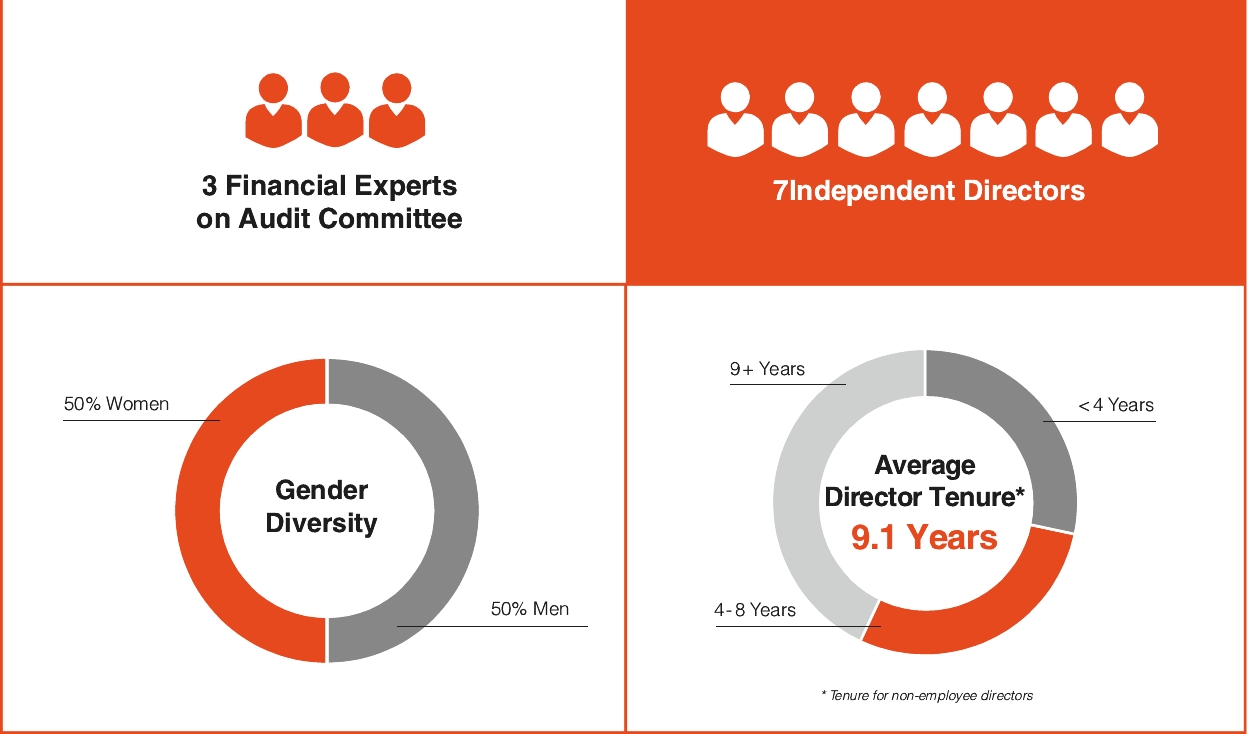

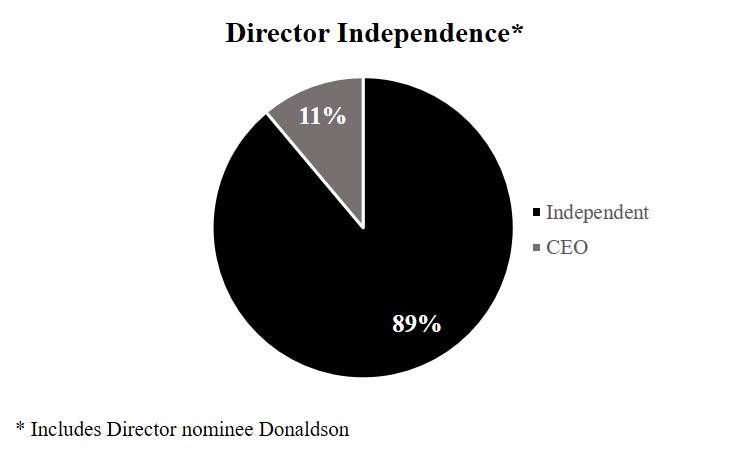

TABLE OF CONTENTS CORPORATE GOVERNANCE HIGHLIGHTS Our Board has implemented policies and structures that we believe are among the best practices in corporate governance. The Corporate Governance section of this Proxy Statement beginning on page 10 describes our governance framework, which includes the following: CURRENT BOARD AND GOVERNANCE INFORMATION | | | | | | | | | | | | | | | 8 | | | 7 | | | 6 | | | 100% | | | | Size of Board | | | Number of

Independent

Directors | | | Board Meetings

Held in 2019 | | | Attendance

at all Board and

Committee Meetings

Held in 2019 | |

SUSTAINABILITY AND ENVIRONMENTAL AND SOCIAL RESPONSIBILITY HIGHLIGHTS Sustainability and environmental and social responsibility is an integral component of our business strategy. As part of Simpson’s vision, we have established deeply rooted core values that continue to define our business today. At the forefront of these values is doing what is right for our employees’ safety and well-being, as well as for our customers, communities and environment. EMPLOYEE SAFETY AND WELL BEING Our people are the most vital part of our business, and providing a safe, healthy and sustainable working environment is of

fundamental importance. We value the safety of all employees, and we continually work to minimize employee exposure to potential risk. SUSTAINABILITY At Simpson, we look at four key aspects of sustainability: MANUFACTURING PROCESSES We strive to minimize the amount of waste generated by our manufacturing processes through companywide lean practices. Our Research & Development engineers are focused on material efficiencies and innovative product features that minimize waste in our steel connector, anchor and fastener designs. RECYCLING We do not manufacture steel and we do not use recycled steel. We recycle the scrap steel resulting from our manufacturing process at all facilities around the world. In addition to steel, we recycle many of the materials that we use to reduce our impact on the environment, including cardboard, plastic and glass bottles, aluminum cans, paper, wood pallets, electronic waste, water, oils, coolants and lubricants and stretch film / wrap — low density polyethylene. ENERGY CONSERVATION We work hard to improve energy efficiencies at our facilities to ensure eco-friendly, cost-effective operations. Energy-efficient lighting, heating and cooling systems further reduce our impact on the environment, including reducing our carbon emissions. SUSTAINABLE BUILDING PRACTICES We support sustainable building practices, such as those established by the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) Green Building Rating System™, NAHB Green, and state and city specific green building codes. Our support includes use of green building technology, advanced framing techniques and use of non- toxic materials. 6 | | | | | | | 2020 Proxy Statement |

TABLE OF CONTENTS We hold ourselves accountable to conducting our business with integrity through adherence to a strict set of standards and policies which are intended to create a safe, sustainable, respectful and healthy work environment, including policies around ethics, data privacy, and more. CORPORATE GOVERNANCE Our Corporate Governance Policies Reflect Best Practices We are committed to maintaining the highest standards of corporate governance. The Board has built a strong and effective governance framework, which has been designed to promote the long-term interests of stockholders and support Board management accountability. | | Majority Vote Standard for Uncontested

Directors Elections | | | | | | Annual Board and Committee Self-Evaluations and Review of Director Qualifications | | | | Annual Election of All Directors | | | | | | Executive Sessions of Independent Directors Held at Each Regularly Scheduled Board Meeting, and Directors Meet Periodically Throughout the Year with Individual Members of Management | | | | Non-Executive Independent Chair of the Board | | | | | | 100% Attendance of Incumbent Directors at Board and Committee Meetings | | | | Seven of Eight Director Nominees Are Independent | | | | | | Audit and Finance, Compensation and Leadership Development, and Nominating and Governance Committee Members Are

All Independent | |

ITEM 2

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION We recommend that you review our Compensation Discussion & Analysis beginning on page 33, which explains in greater detail the philosophy of the Compensation and Leadership Development Committee and its actions and decisions in 2019 regarding our Named Executive Officer compensation programs. While the outcome of this proposal is non-binding, the Board and Compensation and Leadership Development Committee expect to consider the outcome of the vote when making future compensation decisions. | | The Board recommends a vote FOR this proposal. | | | | |

2020 Proxy Statement | | | | | | | 7 |

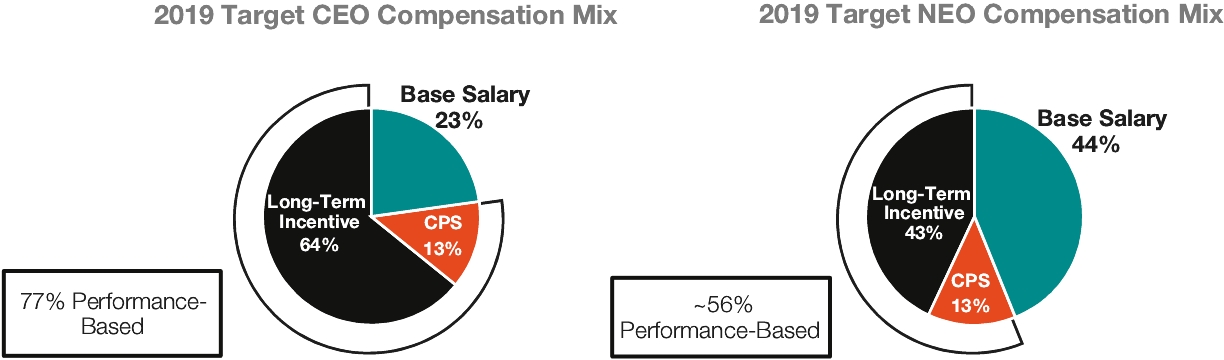

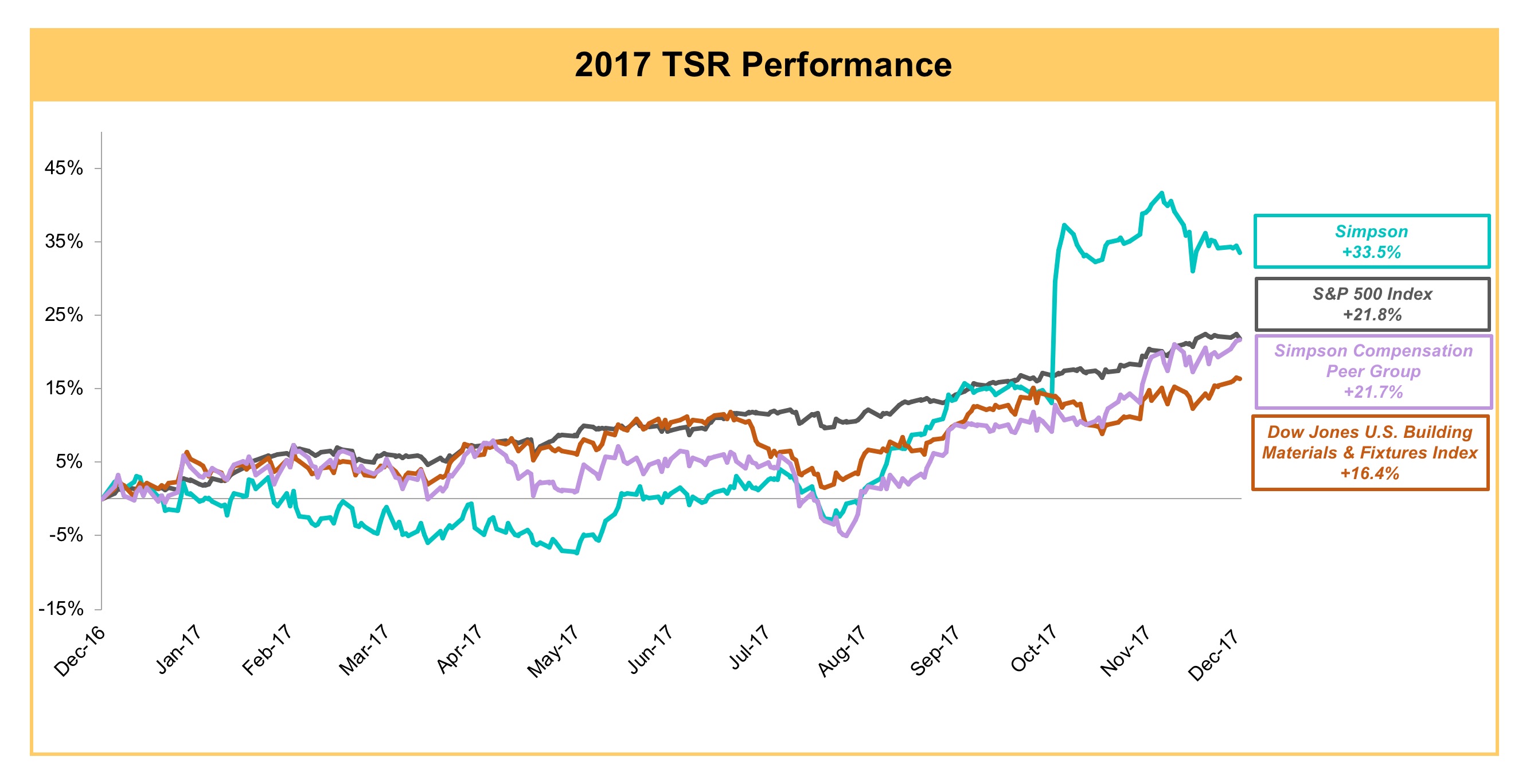

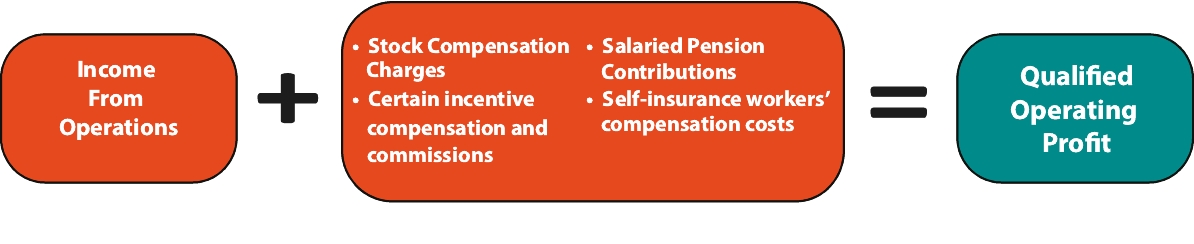

TABLE OF CONTENTS 2019 EXECUTIVE COMPENSATION HIGHLIGHTS Below we highlight certain of our executive compensation policies and practices, including both those which we utilize to drive performance and those which we prohibit because we do not believe they would serve our stockholders’ long-term interests. EXECUTIVE COMPENSATION SUMMARY Simpson’s executive compensation philosophy emphasizes pay-for-performance. Our philosophy is to provide executive compensation opportunities that approximate the 50th percentile of appropriate market data that is based on our revenue size and industry. Our incentive plans are designed to reward strong performance, with greater compensation paid when performance exceeds expectations and less compensation paid when performance falls below expectations. Thus, the actual compensation realized by our Named Executive Officers (“NEOs”) will be commensurate with the Company’s actual performance. Our Compensation and Leadership Development Committee has a practice of reviewing executive compensation program components, targets and payouts on an annual basis to ensure the strength of our pay-for-performance alignment. Our performance is evaluated against both short-term goals, which support Simpson’s business strategy, and long-term goals, which measure the creation of sustainable stockholder value. Executive Compensation Key Policies and Practices | | Target Total Compensation at 50th Percentile | | | | | | Executive Officer Stock

Ownership Guidelines | | | | Independent Consultant Retained by the Compensation and Leadership Development Committee | | | | | | Executive Compensation Clawback Policy | | | | “Double-Trigger” Change-in-Control Treatment for Long-Term Compensation Awards | | | | | | Directors and Executive Officers Prohibited from Hedging or Pledging of Common Stock | | | | Payout Caps on Incentive Awards | | | | | | Annual Review of Risk Related to

Compensation Programs | | | | Relative Pay-for-Performance Alignment | | | | | | Annual Say on Pay Vote | |

At our 2019 Annual Meeting of Stockholders, Simpson again received strong support for its NEO compensation programs, with approximately 99% of votes cast approving, on an advisory basis, our NEO compensation. In 2019, as in prior years, the Compensation and Leadership Development Committee considered input from our stockholders and other stakeholders as part of its annual review of Simpson’s executive compensation program. Please see the “Compensation Discussion & Analysis” section in this Proxy Statement for a detailed description of our NEO compensation programs. Compensation Risk Assessment As part of its oversight of the Company’s executive compensation program, the Compensation and Leadership Development Committee reviews and considers any potential risk implications created by compensation. The Compensation and Leadership Development Committee believes that the executive compensation program is designed with the appropriate balance of risk and reward in relation to the Company’s overall business strategy and that the balance of compensation elements does not encourage excessive risk taking. The Compensation and Leadership Development Committee will continue to consider compensation risk implications, as appropriate, in designing any new executive compensation components. In connection with its ongoing risk assessment, the Compensation and 8 | | | | | | | 2020 Proxy Statement |

TABLE OF CONTENTS Leadership Development Committee notes the following attributes of the executive compensation program: the balance between fixed and variable compensation, short- and long-term compensation, and cash and equity payouts; the alignment of long-term incentives with selected performance measures that consider peer median performance expectations and reflect the Company’s business plan and its financial and operational goals; the placement of a significant portion of executive pay “at risk” and dependent upon the achievement of specific corporate performance goals with verifiable results, with pre-established threshold, target and maximum payment levels; the Company’s compensation recoupment policy, which applies to performance-based cash and performance-based incentive compensation paid to executive officers and other recipients; the balance between risks and benefits of compensation as related to attracting and retaining executives and other senior leaders; the Company’s executive stock ownership guidelines, which align the interests of the executive officers with those of the Company’s stockholders; and regular review of the executive compensation program by an independent compensation consultant. The Compensation and Leadership Development Committee also has oversight over the Company’s responsibility to review significant Company compensation policies and procedures, including the incentives that they create, to assess risk. At the Compensation and Leadership Development Committee’s direction, the Company’s Human Resources Department, in partnership with Meridian, the Compensation and Leadership Development Committee’s independent consultant conducted a risk assessment of the Company’s compensation programs. Based on this assessment, management has concluded that the compensation policies and practices of the Company and satisfy certain regulatory requirements. See “Director Selection Criteria” below. Director Terms